“Digital finance transformation” became an even more important topic over the past two years as finance and accounting departments have had to cope with an unrelenting set of new challenges that have had a profound impact on business operations, financial markets and regulatory environments. Digital technologies enable organizations to cope with change and improve performance by increasing efficiency, reducing risk, achieving greater visibility into opportunities, shortening process cycles and completing core processes. Digitizing department operations helps attract and retain the best talent because professionals spend less time on mechanical, repetitive tasks. Unfortunately, our research suggests that transformation is more talked about than done. I assert that by 2025, only one-third of finance departments will have achieved a level of technology competence to be described as digitally transformed while the CFOs of those that do will have greater influence in their organization's management.

One easily overlooked opportunity for digital transformation is in sourcing and procurement, which should be a priority focus for digital transformation because in most companies this-png-1.png?width=300&name=VR_2022_OOF_Assertion_5_Square%20(1)-png-1.png) function continues to operate as it did in the late 1990s. Updated technology can improve procurement’s effectiveness, streamline processes and automate repetitive work. In addition to this increased efficiency, teams can collaborate using their knowledge of products, vendors and markets to select and source the best materials, products and services from the most appropriate vendors. Technology also can improve the efficiency of the buying process while ensuring guidelines, controls and regulations are observed and costs are minimized. Technology also can simplify the acquisition of indirect goods and services (such as computers and office supplies) while minimizing their cost and controlling outlays.

function continues to operate as it did in the late 1990s. Updated technology can improve procurement’s effectiveness, streamline processes and automate repetitive work. In addition to this increased efficiency, teams can collaborate using their knowledge of products, vendors and markets to select and source the best materials, products and services from the most appropriate vendors. Technology also can improve the efficiency of the buying process while ensuring guidelines, controls and regulations are observed and costs are minimized. Technology also can simplify the acquisition of indirect goods and services (such as computers and office supplies) while minimizing their cost and controlling outlays.

Any transformation process begins with a critical gap analysis: What does sourcing and procurement do now versus what it should be doing? Technology can act as the catalyst for recreating the department’s mission to serve the needs of the company more effectively.

Digitally transformed sourcing and procurement departments can play a more active, productive role across the entire company. For instance, based on its knowledge of markets and vendors, department specialists can advise R&D on technical developments and pricing trends that will affect product cost, functionality, durability, producibility and serviceability. In manufacturing and logistics, it can find ways to consolidate purchases to take advantage of volume discounts. Departments that have developed digital advertising and marketing specialists can assist product managers in developing modern differentiated sales and marketing strategies.

On the indirect side, outlays account for a significant share of operating expense in many organizations. Transaction volumes can be heavy, so finance and accounting departments often must devote a considerable amount of time to transaction management and cost control. With the right technology and a repurposed purchasing department, a finance organization as a whole is better able to support complex innovation and go-to-market strategies. In addition, by automating indirect spend management, finance can reduce this administrative burden while improving compliance with policies related to indirect spend.

Sourcing and procurement executives who want to transform their department’s mission should recognize the important role that software can play. By streamlining processes and reducing frictions that are inherent in manual systems, dedicated applications can make sourcing and procurement an enabler rather than a roadblock for managers and employees.

In strategic sourcing, software that enables high adoption and usability can manage the entire process more effectively. It will give senior sourcing and procurement executives a full view of the portfolio of active and planned sourcing and procurement projects. Having a single, connected and centralized system with automated workflows for collaboration ensures that sourcing projects and requests are routed to the right individuals, and that handoffs between people and departments are always crisp.

Such a system also automates the handling of exceptions and escalations. Managers have visibility into their processes and can examine supplier relationships and contractual obligations so managing these becomes easier. It can provide alerts when issues arise such as processes falling behind schedule or when necessary steps aren’t started on time. Today’s applications must go beyond monolithic approaches focused mainly on compliance; they must add overall business value.

Collaboration between departments in strategic sourcing and procurement is essential. The best software enables cross-functional teams to share information quickly and efficiently, establish a record of their deliberations and store and access documents. Such a system gives all interested parties ready access to purchase information rather than forcing them to hunt through scattered spreadsheets and email messages. And consolidating all sourcing and procurement-related data in a dedicated system allows departments to analyze their performance more easily.

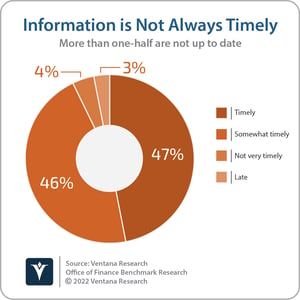

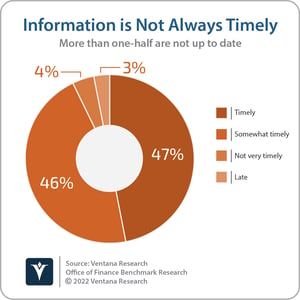

Outlays for individual purchases of indirect goods and services typically involve trivial amounts, but in many companies, they represent a significant share of controllable expenses. Using a dedicated application for indirect spend management, especially in conjunction with payment cards, makes it easier to manage the high volume of indirect purchases. Software that automates the sourcing process makes it easier — and more enjoyable — for the business, stakeholders and vendors to comply with policies while making it easier for finance organizations to benefit from volume discounts and avert duplicative or unnecessary spending. It aggregates planning and sourcing data that otherwise may be scattered and inconsistent and automates data capture to ensure that spend data and analytics is not only accurate but immediately available to budget owners. Our Office of Finance Benchmark Research revealed that only 47% of departments provide timely information to the rest of the organization. Procurement teams today must be ready to adapt on the fly to achieve better business outcomes and this requires data.

expenses. Using a dedicated application for indirect spend management, especially in conjunction with payment cards, makes it easier to manage the high volume of indirect purchases. Software that automates the sourcing process makes it easier — and more enjoyable — for the business, stakeholders and vendors to comply with policies while making it easier for finance organizations to benefit from volume discounts and avert duplicative or unnecessary spending. It aggregates planning and sourcing data that otherwise may be scattered and inconsistent and automates data capture to ensure that spend data and analytics is not only accurate but immediately available to budget owners. Our Office of Finance Benchmark Research revealed that only 47% of departments provide timely information to the rest of the organization. Procurement teams today must be ready to adapt on the fly to achieve better business outcomes and this requires data.

A dedicated application adds value by quickly improving the efficiency and effectiveness of an organization’s sourcing and procurement. Automated workflows increase efficiency and enable a department to manage by exception. Greater efficiency means the entire organization spends less time on routine requisitioning and ordering. By making ordering “by the book” easy, companies can achieve cost savings by concentrating purchases on authorized vendors, especially those where volume purchase agreements are in force, and ensure that invoiced prices and discounts match what’s in the contract. Accelerated improvements and quick wins give the rest of the organization the confidence that sourcing and procurement is able to adapt and prosper.

Software also enhances corporate effectiveness because the purchasing staff spends less time on routine work, leaving more time for them to be a resource supporting the complex sourcing of materials and services. This shift can enhance the quality of the products and services the company offers. A dedicated system provides more thorough visibility into all direct and indirect spend because cash commitments are tracked from purchase order approval. This also reduces risk because such visibility enables scrutiny of future cash commitments and identifies bad actors in the sourcing and procurement process.

Digital transformation means shifting more of the work the department does manually using emailed spreadsheets to software and systems. A practical approach to the transformation process is to undertake the change in a series of initiatives rather than a single big-step overhaul. This approach is preferred because there’s usually limited staff time available for a singular focus on transformation. Moreover, a step-by-step approach enables departments to gather success metrics and apply lessons learned so they can better manage the transformation project. In determining the order of transformation projects, executives should prioritize those that will deliver a high payoff with limited risk. Sourcing and procurement is a good place to start.

Investing in purchasing software can enhance the strategic value of the finance department. It makes it possible for a department to redefine its role to serve as an enabler of better business outcomes. Digitizing purchasing with dedicated software supports this role while providing better control and visibility of corporate spending without needlessly encumbering the process. I recommend that CFOs, especially those that have a purchasing department reporting to them, focus on digitizing the sourcing and purchasing function.

Regards,

Robert Kugel

-png-1.png?width=300&name=VR_2022_OOF_Assertion_5_Square%20(1)-png-1.png) function continues to operate as it did in the late 1990s. Updated technology can improve procurement’s effectiveness, streamline processes and automate repetitive work. In addition to this increased efficiency, teams can collaborate using their knowledge of products, vendors and markets to select and source the best materials, products and services from the most appropriate vendors. Technology also can improve the efficiency of the buying process while ensuring guidelines, controls and regulations are observed and costs are minimized. Technology also can simplify the acquisition of indirect goods and services (such as computers and office supplies) while minimizing their cost and controlling outlays.

function continues to operate as it did in the late 1990s. Updated technology can improve procurement’s effectiveness, streamline processes and automate repetitive work. In addition to this increased efficiency, teams can collaborate using their knowledge of products, vendors and markets to select and source the best materials, products and services from the most appropriate vendors. Technology also can improve the efficiency of the buying process while ensuring guidelines, controls and regulations are observed and costs are minimized. Technology also can simplify the acquisition of indirect goods and services (such as computers and office supplies) while minimizing their cost and controlling outlays. expenses. Using a dedicated application for indirect spend management, especially in conjunction with payment cards, makes it easier to manage the high volume of indirect purchases. Software that automates the sourcing process makes it easier — and more enjoyable — for the business, stakeholders and vendors to comply with policies while making it easier for finance organizations to benefit from volume discounts and avert duplicative or unnecessary spending. It aggregates planning and sourcing data that otherwise may be scattered and inconsistent and automates data capture to ensure that spend data and analytics is not only accurate but immediately available to budget owners. Our Office of Finance Benchmark Research revealed that only 47% of departments provide timely information to the rest of the organization. Procurement teams today must be ready to adapt on the fly to achieve better business outcomes and this requires data.

expenses. Using a dedicated application for indirect spend management, especially in conjunction with payment cards, makes it easier to manage the high volume of indirect purchases. Software that automates the sourcing process makes it easier — and more enjoyable — for the business, stakeholders and vendors to comply with policies while making it easier for finance organizations to benefit from volume discounts and avert duplicative or unnecessary spending. It aggregates planning and sourcing data that otherwise may be scattered and inconsistent and automates data capture to ensure that spend data and analytics is not only accurate but immediately available to budget owners. Our Office of Finance Benchmark Research revealed that only 47% of departments provide timely information to the rest of the organization. Procurement teams today must be ready to adapt on the fly to achieve better business outcomes and this requires data.