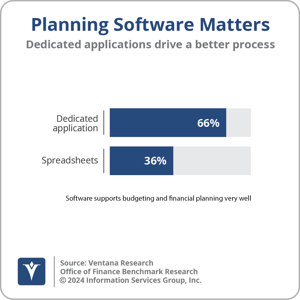

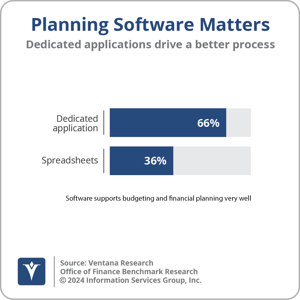

We live in an era of uncertainty, not unpredictability. Managing in uncertain times is always difficult, but tools are available to improve the odds for success by making it easier and faster to plan for contingencies and scenarios. Software makes it possible to manage ahead of any future event, connecting the tactical trees to the strategic forest. The purpose of planning is not just to create a plan: Enterprises spend time thinking ahead because it enables leadership teams, executives and managers to make more useful and better coordinated decisions faster and more consistently. Planning software eliminates the time analysts and others typically must spend on the mechanics and plumbing of the process. This gives them more time to focus on making planning a high-participation, interactive dialog focused on the tactics and resources necessary to achieve objectives. Software makes it possible to substantially shorten planning cycles, enabling enterprises to be more agile in responding to change. Our Office of Finance Benchmark Research finds that 66% of enterprises that use dedicated planning and budgeting software have a process that works well or very well, compared to 36% that do not.

Dedicated planning and budgeting software has been around for decades but is about to become even more useful as providers increasingly incorporate artificial intelligence (AI) into their applications. AI will be the most consequential technology of this decade for business computing. The scope of applicable uses for AI in business is vast, some of which are either in use for business today or will be shortly. Others are highly speculative or will be practical at some undetermined time. There are well-within-reach use cases for business-focused AI capabilities, including:

their applications. AI will be the most consequential technology of this decade for business computing. The scope of applicable uses for AI in business is vast, some of which are either in use for business today or will be shortly. Others are highly speculative or will be practical at some undetermined time. There are well-within-reach use cases for business-focused AI capabilities, including:

- Accelerating forecasting and planning while reducing bias.

- Automating analytics production to enable more time for analysis and thought.

- Providing task supervision to spot data and information input errors.

- Adding recommendations to facilitate decision-making.

- Automating commentary to enhance reporting.

The use of large language models (LLMs), especially in the realm of generative AI (GenAI), will substantially expand this list.

Ventana Research asserts that by 2027, almost all providers of software designed for finance organizations will incorporate AI capabilities to reduce workloads and improve performance. Increasingly, providers of software aimed at the office of finance will differentiate offerings by the capabilities and accuracy of AI functionality. The main objective of AI-enhanced software is for the applications to do more low-value work so people can contribute more. Organizations will adopt this technology to attract and retain the best talent because there is more time for workers to focus on tasks that require their expertise, experience and judgment.

Increasingly, providers of software aimed at the office of finance will differentiate offerings by the capabilities and accuracy of AI functionality. The main objective of AI-enhanced software is for the applications to do more low-value work so people can contribute more. Organizations will adopt this technology to attract and retain the best talent because there is more time for workers to focus on tasks that require their expertise, experience and judgment.

At the same time, this software is both necessary and insufficient. To achieve full value, it must be part of an organizational and process approach to budgeting and planning that we call Integrated Business Planning (IBP), a term we coined in 2007. I advise financial planning and analysis (FP&A) groups to take a fresh look and evaluate their mission given the disruption that AI will bring. They should consider potentially redefining what they do to emphasize their role as an enterprise resource that supports more effective, agile and accurate planning but also simplifies the task for individual business units. Such a shift is possible because AI-infused IBP software will make FP&A far more productive.

Even when enterprises adopt dedicated planning and budgeting software, the budget owners — and others outside of the finance department who are involved in the process — often still are not happy. That is mainly because technology has not increased the business value of budgeting, especially to the budget owners and the executives who manage them. Technology helps the CFO and FP&A organization create planning models, produce a detailed budget and analyze “the numbers” with less effort than was required in the past. That is important, but it is not enough.

To make budgeting more valuable to running an enterprise, FP&A must also model and measure the “things,” or resources, that budget owners use to achieve their business objectives, not just calculate their monetary value. When budget owners plan and budget, they usually think in terms of the things they need to run their part of the enterprise, such as headcount, advertising campaigns, facilities, laptops and other items. The budgeting system must be able to simultaneously translate this list of resources into accounting line items so the system can aggregate the financial data into an enterprise-wide budget and financial forecast. This is an area where AI and predictive analytics can make this approach far easier to implement because, with the right data, systems can automate the creation and refinement of performant models that connect operating data (things) with the financial numbers.

Starting with a list of resources simplifies the process for budget owners; it is a user-friendly approach. Budget owners can focus on the things they need, and the software model translates that list quickly and accurately into a financial budget to address the needs of the finance department. It is a simple idea, but it takes technology — the right technology — to make it feasible and practical.

Creating an integrated operating and financial plan is a better way to budget and is consistent with a zero-based budgeting approach. When it comes time to negotiate a department’s budget, the discussion is not about abstract numbers in a spreadsheet, it is about whether the department needs the specific resources (such as people, business trips and purchased parts) to achieve their top-down objectives or if, recognizing financial constraints, the objectives need changing.

AI-enabled planning software will also make contingency planning faster and more accessible. Today’s business planning challenges are the result of rapid evolution of secular trends in markets, economies and politics as well as impactful events that accompany these sea changes. It’s no longer adequate to answer what-if questions with “I’ll get back to you with that,” because successfully planning next steps in a dynamic environment requires a free-flowing dialog. Today’s planning applications achieve speedy scenario development, helping good managers make better decisions faster and more consistently.

Contingency planning is at the heart of good management. When reviewing organizational operating and financial plans, the best executives I’ve known always ask, “What will you do when your plan doesn’t work?” Contingency planning provides thoughtful answers to that question, including the impact of various scenarios on financial statements, profitability, market share and operating metrics. And since these scenarios integrate operational and financial projections, they offer executives a full view of the implications of a given scenario. Having the ability to rapidly model and plan different scenarios at a useful level of detail enables enterprises to assess different options more frequently and pivot quickly when conditions change enough to warrant it.

Integrating operational and financial projections makes planning more of a management tool. For instance, if a port strike is threatened, enterprises need to assess how that will affect product availability. If the shutdown stretches into weeks or months, what is the best response, including the optimal allocation of available product? And what are the financial implications on earnings, balance sheet impacts and the effect on cash flow? In a mild recession, allocating resources to sustain efforts in attractive markets while cutting less strategic investments can provide a competitive edge. Executives must be able to accurately evaluate the impact of multiple scenarios on the business to understand their options and trade-offs. And doing so requires a planning and budgeting process that delivers answers about scenarios that are accurate, efficient and fast, as in minutes not hours or days.

By streamlining planning and budgeting cycles, IBP gives executives and managers time to assess different scenarios and contingencies. Business is all about managing trade-offs because resources are always limited. Yet because enterprises lack the technology to perform short planning cycles, our research reveals that 58% of businesses of all types and sizes have little or no ability to measure trade-offs in the plans in which they are involved.

I recommend that all midsize and larger enterprises adopt dedicated planning and budgeting software to improve performance. It’s also essential to craft a data management strategy that incorporates a data pantry to support better planning and, potentially, a planning center of excellence to manage the process. We live in an era of uncertainty, not unpredictability. Technology enables senior leadership teams to manage more intelligently to achieve greater resiliency and agility.

Regards,

Robert Kugel

their applications. AI will be the most consequential technology of this decade for business computing. The scope of applicable uses for AI in business is vast, some of which are either in use for business today or will be shortly. Others are highly speculative or will be practical at some undetermined time. There are well-within-reach use cases for business-focused AI capabilities, including:

their applications. AI will be the most consequential technology of this decade for business computing. The scope of applicable uses for AI in business is vast, some of which are either in use for business today or will be shortly. Others are highly speculative or will be practical at some undetermined time. There are well-within-reach use cases for business-focused AI capabilities, including: Increasingly, providers of software aimed at the office of finance will differentiate offerings by the capabilities and accuracy of AI functionality. The main objective of AI-enhanced software is for the applications to do more low-value work so people can contribute more. Organizations will adopt this technology to attract and retain the best talent because there is more time for workers to focus on tasks that require their expertise, experience and judgment.

Increasingly, providers of software aimed at the office of finance will differentiate offerings by the capabilities and accuracy of AI functionality. The main objective of AI-enhanced software is for the applications to do more low-value work so people can contribute more. Organizations will adopt this technology to attract and retain the best talent because there is more time for workers to focus on tasks that require their expertise, experience and judgment.