More businesses are using software to implement and support a strategic pricing strategy designed to optimize revenue and margins in business-to-business (B2B) transactions because it can help improve results at the bottom line. “Optimize” in this instance means managing the trade-off that usually exists between revenue and profitability objectives in order to support a company’s strategy and capabilities in a given market. Business-to-business pricing management is Ventana Research’s term for such processes and applications. Software built for this purpose centralizes control and enforces consistency in pricing while assisting sales agents in negotiating prices that achieve desired business objectives. It enables agents to use techniques that can increase the revenue from a transaction, the margin on the sale or the probability of closing the sale.

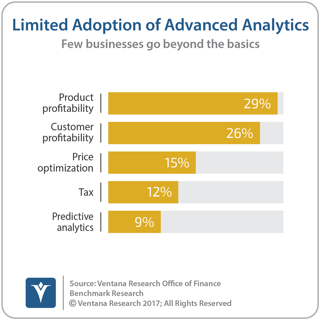

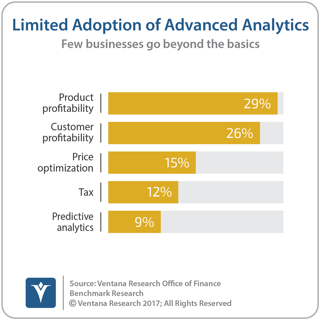

Although B2B PM software is gaining acceptance, the market is only slightly penetrated. Our Office of Finance benchmark research finds that just 15 percent of companies use analytics to optimize their pricing, only one-fourth (26%) use analytics to manage customer profitability, and fewer than one-third (29%) manage product profitability that way.

There are many ways for companies to use  software to manage pricing and profitability. The central feature of the approach that we call B2B PM is using configure, price and quote (CPQ) software or its equivalent functionality. CPQ software enables sales agents to take advantage of buyers’ individual levels of sensitivity to the price of each component of a complex product or service – “complex” in the sense of having more than one component. In its simplest form, it might include a basic product or service and one or more options to suit the specific needs of the buyer. In more complicated form it might involve a contract for dozens of components, each with its own set of options. (More on this below.)

software to manage pricing and profitability. The central feature of the approach that we call B2B PM is using configure, price and quote (CPQ) software or its equivalent functionality. CPQ software enables sales agents to take advantage of buyers’ individual levels of sensitivity to the price of each component of a complex product or service – “complex” in the sense of having more than one component. In its simplest form, it might include a basic product or service and one or more options to suit the specific needs of the buyer. In more complicated form it might involve a contract for dozens of components, each with its own set of options. (More on this below.)

Either way, the mechanism for negotiating prices in B2B sales is usually adjusting the discount of each component and option from a list price. Sales agents have varying degrees of leeway to negotiate discounts based on guidelines set by managers. These guidelines may be based on a pricing manager’s experience and judgment. Alternatively, discount guidelines for each component can be established using price and revenue optimization analytics. This approach applies algorithms to historical sales data in order to more accurately assess a specific prospective buyer’s price sensitivity for each sale component.

Let’s drill down on the software.

A central piece of a B2B PM system is software that performs configure, price and quote functions. To put this software category in context, it’s worth noting that originally CPQ was designed to simplify the process of assembling a price quote for a sale involving a complicated set of components. For example, buyers of large commercial trucks typically can choose from multiple engines, cab designs, transmissions and trailer types. There can be large numbers of permutations, and not every combination of components is valid. For example, with some chassis, the choice of engines may be limited because a given engine might not fit that chassis. The choice of engine can limit the buyer’s trailer options if it lacks the horsepower to pull it. Software that can sort out this kind of complexity and produce a valid quote quickly has proven useful in many industries.

Over time CPQ software also has been used increasingly to manage revenue and margins. To minimize margin leakage it can be used control the discount from list price offered to the prospect on each component of the sale. It also can prompt sales people to recommend complementary products and services to the buyer to increase the size of the transaction. In its basic form, the discount guidance and control applied to each sale component can be based on experience-driven judgment.

However, experience isn’t always the best guide to pricing. One of the reasons why companies adopt advanced analytics is because the best decision may be counterintuitive. For example, in retailing, starting early with a series of small markdowns for seasonal or fashion-driven goods turns out to produce higher revenue and fatter margins than the accepted practice of waiting until much later and making a larger, ostensibly more impressive reduction. In banking, numbers show that the most loyal customers are willing to pay more for loans or accept lower deposit rates. They don’t need to be rewarded to remain loyal.

Because experience isn’t always the best guide, some software for B2B pricing management employs price and revenue optimization (PRO) techniques, which can produce better results in setting prices or discounts. PRO is a business discipline used to effect demand-based pricing; it applies market segmentation techniques to achieve strategic objectives such as increased profitability or greater market share. In essence, it enables companies to surf the demand curve using dynamic rather than fixed pricing to achieve the most desirable trade-off between revenue volume and profit margins. The trade-off is defined by strategic factors such as the company’s market position, product and service portfolio, and marketing strategy.

Typically, B2B transactions are different from the business-to-consumer (B2C) kind in at least four respects. One is that B2B usually involves a price negotiation between potential customers and sales representatives, who usually have some degree of pricing discretion. That is, within established bounds, they can offer a discount to the list price or include products or services of value (such as shipping or a longer warranty) at the stated price. Another is that unit volumes in the sale of, say, industrial equipment and supplies are smaller than in consumer goods and services. As a result, companies have less data on which to model buyers’ behavior, limiting their ability to segment buyers and tune their measurements of price sensitivity. A third characteristic is that the buyer usually is acting as an agent, not a principal, in the transaction, and therefore can have a different set of motivations than someone purchasing a consumer good for his or her own enjoyment. Fourth, as already noted, the products involved in B2B commerce are not monolithic; that is, they provide buyers with multiple options for multiple components. This can range from highly configured products such as Class 8 trucks to simpler examples such as a single item with different shipping options.

The techniques used in B2B price management are different from those used by businesses such as airlines, retailers or banks because of the differences between B2B and consumer transactions. The use of configure price and quote functionality enables companies to structure their product and service offerings as bundles of discrete items rather than a single item. This enables them to vary the pricing on each component according to their assessment of the buyer’s price sensitivity. The use of software for quoting can provide companies with greater control over individual deal pricing, thereby reducing unnecessary margin leakage. And the software can be designed to prompt sales agents to offer complementary goods and services – and manage their pricing – to increase the value of the transaction.

Where there are sufficient volumes of transactions, companies can use PRO analytics to achieve more consistently accurate buyer segmentation, potentially at finer granularity. Consequently, they are more likely to be successful in managing pricing to increase the likelihood of closing sales at a desired level of profitability.

B2B price management software is just entering the mainstream phase of the adoption cycle; it is decades behind revenue management by airlines and hotels, and lags retail and financial services as well. One reason for the slower uptake is that it’s challenging for B2B companies to implement a new strategic pricing strategy. They are challenged to simultaneously address people, process and data issues that cross organizational silos. By contrast, transportation and hospitality required fewer organizational changes to implement revenue management.

A major shift in pricing management usually requires a B2B company to effect a change management process. Its purpose is to bring together several groups within a company (typically some combination of sales, finance, senior executives and operations) to agree on adopting a strategy and developing ways to put it into practice. Companies also must be able to manage the process effectively on a daily basis through executive buy-in, ongoing training and an organizational structure that supports a sustained price optimization strategy. Having the right data to be able to price more successfully usually requires a substantial up-front effort and a well-defined ongoing process to ensure the data is clean and relevant. All of this has to be accomplished without disrupting daily business activities.

Our research agenda for 2017 includes expanding our coverage of B2B pricing management vendors and their products as well as covering the topic of pricing management theory and practice. We also will be issuing a Value Index that assess the vendors in this category.

Pricing strategy and execution can have a profound impact on a company’s bottom line, its return on invested capital and its long-term competitiveness. I recommend that companies with B2B business models examine their pricing strategy and practices to assess whether they can benefit from using B2B PM software to achieve better results.

Regards,

Robert Kugel

Senior Vice President Research

Follow me on Twitter @rdkugelVR

and connect with me on LinkedIn.