By its own admission, SAS has a very large software portfolio (of more than 250 individual products), and it continues to develop and release more products and updates to existing ones. Some of the products are sold alone, and others are bundled into “enterprise solutions”. Some are for technical users, and others are business applications. This complexity can make it hard to identify which product or bundle serves a particular need. Three are most relevant to my research practice: Customer Intelligence (CI), which I wrote about after attending the 2013 SAS European analysts event; SAS Visual Analytics; and a new one, the Customer Decision Hub that SAS has developed to support multichannel customer engagement.

When I last wrote about Customer Intelligence I noted that it was designed mainly to process structured customer data (such as found in CRM and ERP applications and customer data warehouses) and the analysis it generated was largely for use in marketing. At this year’s analyst event SAS highlighted several developments, but most are to support marketing better, although some directly impact customer engagement. One of the challenges in understanding CI is that it is a bundle of 11 products, and that doesn’t include products that are part of the underlying SAS technology platform. Of the 11 business applications, six relate directly to marketing, and one, SAS Profitability Management, allows companies to understand and manage profitability at a detailed level. The remaining four products relate more to customer engagement: SAS Customer Link Analytics (designed to identify the communities in which customers interact), Real-Time Decision Manager (to deliver personalized offers derived from rules-based analytics), Adaptive Customer Experience (to create profiles of customers based on interactions and other customer data) and Social Media Analytics (to view and analyze customer activity on social media). Collectively the CI bundle of products supports the end-to-end marketing process, but a lot of the capabilities also relate to sales and customer service. The issue for potential customers thus becomes which of the products directly serve their business objectives and what impact picking among them has on pricing, implementation and ongoing operations.

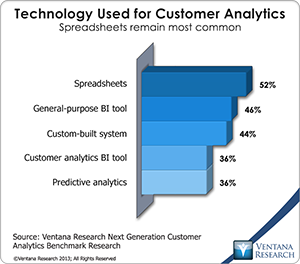

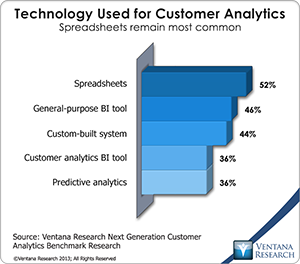

SAS Visual Analytics is a product that makes it possible for business users to create and run their own analytics. This is especially relevant in the contact center and customer service business units. My benchmark research into next-generation customer analytics shows that unlike most other business units, these tend not to have data scientists or analysts to help them produce analysis of customer-facing activities. Instead they rely on managers to produce their own reports and analysis, and as the research shows, they rely heavily on spreadsheets to do this. After IT sets up access to the right data stores, Visual Analytics helps business users create their own analysis requirements and run these against the data sources to produce the analysis and metrics they need. It thus enables managers to keep up with the ever increasing demands of customers and to base decisions on the most up-to-date information, without having to rely so much on IT assistance.

My benchmark research into next-generation customer engagement shows that customer engagement is a multichannel task that is carried out by multiple business units, which CI and Visual Analytics both support. Companies thus need to recognize that  customer engagement is a cross-business responsibility that should be based on a single view of the customer, be rules-based to ensure consistency and the best possible outcomes, and should use multiple forms of analytics, on all sources of customer data, to provide the analysis and metrics to monitor and assess past performance and influence future actions. My benchmark research into next-generation customer analytics shows that many businesses have not made this transition yet and still rely on tools not suited for these tasks. The most common tool (used by 52% of companies) to monitor and assess customer-related activities is spreadsheets; only 26 percent have deployed a dedicated customer analytics tool. While spreadsheets have their place, they cannot process unstructured data and cannot work in real time to provide advice such as next best actions a contact center agent should take while talking to a customer.

customer engagement is a cross-business responsibility that should be based on a single view of the customer, be rules-based to ensure consistency and the best possible outcomes, and should use multiple forms of analytics, on all sources of customer data, to provide the analysis and metrics to monitor and assess past performance and influence future actions. My benchmark research into next-generation customer analytics shows that many businesses have not made this transition yet and still rely on tools not suited for these tasks. The most common tool (used by 52% of companies) to monitor and assess customer-related activities is spreadsheets; only 26 percent have deployed a dedicated customer analytics tool. While spreadsheets have their place, they cannot process unstructured data and cannot work in real time to provide advice such as next best actions a contact center agent should take while talking to a customer.

To meet these requirements SAS has developed its Customer Decision Hub. This bundle of products can help businesses achieve an omni-channel experience – that is, consistent, personalized and in-context experiences at all touch points. It includes APIs that allow businesses to capture all customer interactions in real time or batches, regardless of channel, including unstructured interactions such as calls, email, text messages and social media posts. The hub can also capture data about marketing, sales, service and other ad hoc actions. It uses this data to produce analyses, insights and metrics about those actions, put them in context and show history, risks and potential opportunities. The hub also has a rules engine that can recommend actions and the channel through which to communicate with the customer; among the focus of rules are priorities, strategy, constraints, customer preferences, channel restrictions, budgets and contact permissions. The optimization engine is set up using SAS CI Studio, which uses drag-and-drop techniques to create intelligent, rules-driven workflows to create more relevant, personalized customer experiences. The hub thus links external, customer-related interactions and internal processes to provide the analysis and orchestrate actions.

This combination of products, if used properly, could help companies improve customer experiences that cross the boundaries between marketing, sales and service. However, as with CI the Decision Hub includes many applications and capabilities, and much of SAS’s messaging relates to marketing, which I don’t believe does the package justice. Potential customers should make the effort to understand what products are included in Decision Hub, what is involved in running it and the impact it is likely to have across the organization.

One of the strengths of SAS is its range of products, but this can also be a weakness. In their own right, each product supports a robust set of capabilities, but choosing the right set to meet a specific business need seems to be a complex process that often involves third-party consulting services. My colleagues wrote about SAS recently on its focus on business analytics and it work to unify big data across business and IT that also demonstrate how they are bringing many products to a singular focus for business and IT. Also in my view both SAS CI and the Customer Decision Hub focus too much on marketing and not for use across the business. Anything to do with customers is an enterprise issue, not a departmental one. Improving the customer experience is now such a critical issue that companies should look beyond some of the marketing messages and carefully evaluate how SAS can support their customer interaction and overall engagement efforts.

Regards,

Richard J. Snow

VP & Research Director