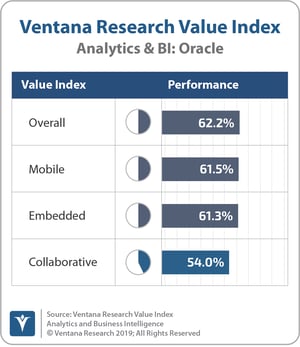

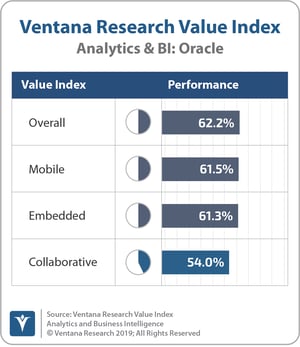

We are happy to offer some insights on Oracle drawn from our latest Value Index research, which assesses how well vendors’ offerings meet buyers’ requirements. Earlier this year we published the Ventana Research Value Index: Analytics and Business Intelligence 2019, the  distillation of a year of market and product research efforts. We then developed three additional Value Indexes on Analytics and BI focusing on mobile, embedded and collaborative capabilities. Because each is a critical aspect of modern business intelligence, we developed specific criteria for each in order to provide an in-depth look at features geared specifically to mobile, embedded and collaborative use.

distillation of a year of market and product research efforts. We then developed three additional Value Indexes on Analytics and BI focusing on mobile, embedded and collaborative capabilities. Because each is a critical aspect of modern business intelligence, we developed specific criteria for each in order to provide an in-depth look at features geared specifically to mobile, embedded and collaborative use.

In all of our Value Indexes we utilize a structured research methodology that includes evaluation categories designed to reflect real-world criteria incorporated in a request for proposal (RFP) and vendor selection process for analytics and business intelligence. We evaluated Oracle and 14 other vendors in seven categories, five relevant to the product (adaptability, capability, manageability, reliability and usability) and two related to the vendor (TCO/ROI and vendor validation). To arrive at the Value Index rating for a given vendor, we weighted each category to reflect its relative importance in an RFP process, with the weightings based on our experience and on data derived from our benchmark research on analytics and business intelligence.

Our analysis is based primarily on Oracle Analytics Cloud (OAC), a public cloud service that Oracle says provides “lift and shift” support for Oracle Business Intelligence Enterprise Edition. Oracle has developed a modern user interface for OAC as well as a broad set of capabilities. The product uses a model of importing data but also supports live access to several of the leading relational databases via its Remote Data Connector.

Overall Oracle ranks 11th in the Value Index assessment. Its best rankings are for Usability and Capability where it ranks seventh and ninth respectively. In addition to good capabilities for data access and interactive visualization assessed in the Value Index, the product provides most of the desired advanced analytics capabilities.

MOBILE ANALYTICS & BI

Our analysis considered both Oracle Analytics Cloud (OAC) and Oracle BI Mobile, a native application for both iOS and Android. Oracle has developed a modern user interface for OAC as well as some nice mobile capabilities in Oracle Day by Day, a part of Oracle Analytics Cloud. Collectively, these products address many of the criteria we evaluate, but using them requires that users switch between products to address all their needs. As a result, Oracle ranks 12th overall in this Value Index assessment.

EMBEDDED ANALYTICS & BI

Oracle’s approach uses a model of importing data but also supports live access to several of the leading relational databases via its Remote Data Connector. Oracle ranks 10th overall in this Value Index assessment. OAC provides good capabilities for analytic discovery and scores well in the output and delivery of information.

Data Connector. Oracle ranks 10th overall in this Value Index assessment. OAC provides good capabilities for analytic discovery and scores well in the output and delivery of information.

COLLABORATIVE ANALYTICS & BI

(OAC performs well in publishing and delivering analyses to line of business users. The product can deliver documents in a variety of formats on a scheduled basis or by subscription, helping to inform users and facilitate communication within the organization. The product also offers good alert capabilities. In the six other capability subcategories Oracle scored at or near average.

OAC doesn’t enable users to add annotations or notes to documents. It also offers limited personalization capabilities compared to other products we evaluated. Additional social-media-style discussion groups along with the capability to assign tasks and track them to completion would help improve Oracle’s ranking in the Value Index.

Better collaborative capabilities would help drive its Usability score higher, as would better integration of the Essbase capabilities into the OAC offering.

Oracle’s lowest rankings are for Validation and TCO/ROI where it ranks 15th and 14th respectively. With a large portfolio of products, it is difficult to find and evaluate information specific to the OAC products such as case studies and services.

This assessment was based on Oracle Analytics Cloud June 2018 release. Oracle released a new version in September 2018 that includes new visualization types, data flow enhancements, data enrichment recommendations and improved search as well as other enhancements. This year it released improvements to further advance its cloud offering to match the depth it offers in its on-premises version.

This research-based index is the most comprehensive assessment of the value of analytics and business intelligence software in the industry. Technology buyers can learn more about how to use our Value Index by clicking here and included vendors that wish to learn more can click here. Read the report here.

Regards

Ventana Research.

distillation of a year of market and product research efforts. We then developed three additional Value Indexes on Analytics and BI focusing on mobile, embedded and collaborative capabilities. Because each is a critical aspect of modern business intelligence, we developed specific criteria for each in order to provide an in-depth look at features geared specifically to mobile, embedded and collaborative use.

distillation of a year of market and product research efforts. We then developed three additional Value Indexes on Analytics and BI focusing on mobile, embedded and collaborative capabilities. Because each is a critical aspect of modern business intelligence, we developed specific criteria for each in order to provide an in-depth look at features geared specifically to mobile, embedded and collaborative use. Data Connector. Oracle ranks 10th overall in this Value Index assessment. OAC provides good capabilities for analytic discovery and scores well in the output and delivery of information.

Data Connector. Oracle ranks 10th overall in this Value Index assessment. OAC provides good capabilities for analytic discovery and scores well in the output and delivery of information.