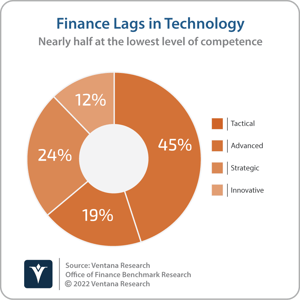

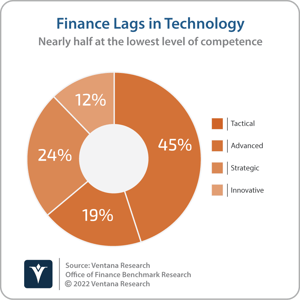

Although the digital transformation of the finance department was a topic of discussion before 2020, it became a front-and-center issue as organizations locked down and in-office interactions became impossible. Finance and accounting departments were immediately confronted with a challenge because of their limited adoption of technology that would support a virtual working environment. As our 2019 Office of Finance Benchmark Research found, they are technological laggards: 45% are at the tactical or lowest level of competence in using technology across multiple processes and functions, while only 12% are at the highest. In my experience, many finance and accounting professionals and those running the department do not necessarily think that such competence is necessary, but this thinking is outdated because, increasingly, technology is the only practical way to address the department’s responsibilities (for example, the new revenue recognition for contracts accounting standards). To gain full advantage of technology, finance and accounting organizations must become “fast followers,” avoiding the bleeding edge but breaking the habit of waiting until the last possible moment before adopting proven advances.

Digitally transforming the office of finance benefits more than just the department because it affects all parts of an organization. For example, technology can enable the whole organization to gain agility, adaptability and resiliency by providing more timely and incisive information about conditions and performance while simultaneously reducing the department’s workload. Automation can cut the time required to complete the accounting close, which puts financial and management analysis into the hands of executives and managers sooner, enabling them to react faster and with greater certainty to opportunities and threats. And, more than a decade of our research has repeatedly shown that analysts spend the majority of their time on data preparation rather than doing what they are trained to do: analysis. Using technology to ensure data integrity and automate data preparation gives analysts more time to do more comprehensive and insightful work.

Digitally transforming the office of finance benefits more than just the department because it affects all parts of an organization. For example, technology can enable the whole organization to gain agility, adaptability and resiliency by providing more timely and incisive information about conditions and performance while simultaneously reducing the department’s workload. Automation can cut the time required to complete the accounting close, which puts financial and management analysis into the hands of executives and managers sooner, enabling them to react faster and with greater certainty to opportunities and threats. And, more than a decade of our research has repeatedly shown that analysts spend the majority of their time on data preparation rather than doing what they are trained to do: analysis. Using technology to ensure data integrity and automate data preparation gives analysts more time to do more comprehensive and insightful work.

Yet, two years after organizations began accelerating investments in technology, it is questionable how much of an impact they have made on departmental operations beyond overcoming the limitations imposed by remote working and therefore whether they have achieved full value from these investments. Our recent Smart Close Dynamic Insights Research finds no statistically relevant change in the percentage of companies completing their monthly close within six business days (60% in 2022 versus 59% in 2019) and a decrease in the percentage of those completing their quarterly close in that time frame (43% and 50%, respectively). The close process is a particularly useful performance benchmark because all companies do it for the same purpose and they do it repeatedly.

Since the 2000s, our research has shown there is no correlation between how soon a company closes its books and any demographic characteristic such as size, industry or geography.

The topic of digital transformation has gained momentum over the past two years as organizations have come to realize that technology can provide them with greater resiliency in managing through unusual circumstances. Even so, progress in applying technology appears limited, reflecting innate caution in adopting software and then adapting processes to use new tools to change roles and tasks. CFOs are generally right to avoid the bleeding edge of technology; however, in a departure from past behavior, they should prepare their department to be a fast follower in information technology to ensure their company’s competitiveness, applying a strategy of quickly imitating the proven innovations of their competitors.

Adopting a fast-follower approach to technology adoption allows the finance and accounting department to shift its focus from what just happened to what is happening next. This kind of department looks at the big picture, supported by details, rather than obsessing over the details — doing bean counting, in other words — so that time is spent not making certain that the numbers are right but rather focused on deriving business insights from the numbers.

-png.png?width=300&name=SmartCloseDI_202204_09_Workflow_speeds_the_close%20(2)-png.png) Yet, despite the potential that technology has created, not much has changed over the past 20 years. There is widespread agreement on the need to complete the close within one business week, but our research shows no improvement in this important metric over this period. Our research consistently finds that companies with similar characteristics (for instance, they are in the same industry, the same size, and operate in the same geographic region) complete their close process at significantly different intervals. The speed with which these organizations close is, however, correlated with their use of technology. Our recent Smart Close Research found that 69% of companies that apply a high degree of automation in their close process complete the process within six business days, while just 29% that use little or no automation can close in this period.

Yet, despite the potential that technology has created, not much has changed over the past 20 years. There is widespread agreement on the need to complete the close within one business week, but our research shows no improvement in this important metric over this period. Our research consistently finds that companies with similar characteristics (for instance, they are in the same industry, the same size, and operate in the same geographic region) complete their close process at significantly different intervals. The speed with which these organizations close is, however, correlated with their use of technology. Our recent Smart Close Research found that 69% of companies that apply a high degree of automation in their close process complete the process within six business days, while just 29% that use little or no automation can close in this period.

How soon a company closes, in turn, has an impact on the timeliness of the information the finance organization provides executives and managers. Our research demonstrates that 75% of companies that complete their close within two business days said the information produced by the finance organization was timely. By contrast, only 20% of those working in companies that take seven or more business days to complete their close said the information they received from the finance department was timely.

There are many reasons why finance departments do not use technology as effectively as they should. Technology vendors and systems integrators have consistently overpromised and under-delivered on benefits to finance departments. For their part, finance and accounting organizations tend to under-invest in software and technology and underutilize the capabilities of the systems they already have. Departments seem to view technology as a force of nature that they cannot control. But they can — and they should.

A fast-follower approach means establishing a standing group with clout that stays abreast of relevant technologies and anticipates their introduction into departmental processes. In the past, there might have been no penalty for a department to have a wait-and-see attitude, reacting slowly instead of finding opportunities to exploit technology capabilities when they become practical. Increasingly, though, delaying the application of technology to finance department processes has negative consequences.

A fast-follower approach is now a necessity because software designed for finance and accounting departments will evolve rapidly over this decade. For example, artificial intelligence using machine learning (AI/ML) will reduce a significant part of the department’s workload currently spent on repetitive tasks and mechanical processes, allowing staff to focus on the more valuable work that requires expertise, experience and judgement. Yet, for all the vocal support for digital transformation, we are not optimistic that departments will advance much over the next several years. Ventana Research asserts that by 2025, only one-third of finance departments will have achieved a level of technology competence that could be described as digitally transformed, and the CFOs of those that do will have greater influence on their organization’s management. These are the fast followers who will have a very real advantage in utilizing technology because they will be able to quickly take advantage of advances as they become available. Those that pursue a wait-and-see strategy — and there will be many — will fall behind and underperform their peers.

A fast-follower approach is now a necessity because software designed for finance and accounting departments will evolve rapidly over this decade. For example, artificial intelligence using machine learning (AI/ML) will reduce a significant part of the department’s workload currently spent on repetitive tasks and mechanical processes, allowing staff to focus on the more valuable work that requires expertise, experience and judgement. Yet, for all the vocal support for digital transformation, we are not optimistic that departments will advance much over the next several years. Ventana Research asserts that by 2025, only one-third of finance departments will have achieved a level of technology competence that could be described as digitally transformed, and the CFOs of those that do will have greater influence on their organization’s management. These are the fast followers who will have a very real advantage in utilizing technology because they will be able to quickly take advantage of advances as they become available. Those that pursue a wait-and-see strategy — and there will be many — will fall behind and underperform their peers.

Regards,

Robert Kugel

Digitally transforming the office of finance benefits more than just the department because it affects all parts of an organization. For example, technology can enable the whole organization to gain agility, adaptability and resiliency by providing more timely and incisive information about conditions and performance while simultaneously reducing the department’s workload. Automation can cut the time required to complete the accounting close, which puts financial and management analysis into the hands of executives and managers sooner, enabling them to react faster and with greater certainty to opportunities and threats. And, more than a decade of our research has repeatedly shown that analysts spend the majority of their time on data preparation rather than doing what they are trained to do: analysis. Using technology to ensure data integrity and automate data preparation gives analysts more time to do more comprehensive and insightful work.

Digitally transforming the office of finance benefits more than just the department because it affects all parts of an organization. For example, technology can enable the whole organization to gain agility, adaptability and resiliency by providing more timely and incisive information about conditions and performance while simultaneously reducing the department’s workload. Automation can cut the time required to complete the accounting close, which puts financial and management analysis into the hands of executives and managers sooner, enabling them to react faster and with greater certainty to opportunities and threats. And, more than a decade of our research has repeatedly shown that analysts spend the majority of their time on data preparation rather than doing what they are trained to do: analysis. Using technology to ensure data integrity and automate data preparation gives analysts more time to do more comprehensive and insightful work.-png.png?width=300&name=SmartCloseDI_202204_09_Workflow_speeds_the_close%20(2)-png.png) Yet, despite the potential that technology has created, not much has changed over the past 20 years. There is widespread agreement on the need to complete the close within one business week, but our research shows no improvement in this important metric over this period. Our research consistently finds that companies with similar characteristics (for instance, they are in the same industry, the same size, and operate in the same geographic region) complete their close process at significantly different intervals. The speed with which these organizations close is, however, correlated with their use of technology. Our recent Smart Close Research found that 69% of companies that apply a high degree of automation in their close process complete the process within six business days, while just 29% that use little or no automation can close in this period.

Yet, despite the potential that technology has created, not much has changed over the past 20 years. There is widespread agreement on the need to complete the close within one business week, but our research shows no improvement in this important metric over this period. Our research consistently finds that companies with similar characteristics (for instance, they are in the same industry, the same size, and operate in the same geographic region) complete their close process at significantly different intervals. The speed with which these organizations close is, however, correlated with their use of technology. Our recent Smart Close Research found that 69% of companies that apply a high degree of automation in their close process complete the process within six business days, while just 29% that use little or no automation can close in this period. A fast-follower approach is now a necessity because software designed for finance and accounting departments will evolve rapidly over this decade. For example, artificial intelligence using machine learning (AI/ML) will reduce a significant part of the department’s workload currently spent on repetitive tasks and mechanical processes, allowing staff to focus on the more valuable work that requires expertise, experience and judgement. Yet, for all the vocal support for digital transformation, we are not optimistic that departments will advance much over the next several years. Ventana Research asserts that by 2025, only one-third of finance departments will have achieved a level of technology competence that could be described as digitally transformed, and the CFOs of those that do will have greater influence on their organization’s management. These are the fast followers who will have a very real advantage in utilizing technology because they will be able to quickly take advantage of advances as they become available. Those that pursue a wait-and-see strategy — and there will be many — will fall behind and underperform their peers.

A fast-follower approach is now a necessity because software designed for finance and accounting departments will evolve rapidly over this decade. For example, artificial intelligence using machine learning (AI/ML) will reduce a significant part of the department’s workload currently spent on repetitive tasks and mechanical processes, allowing staff to focus on the more valuable work that requires expertise, experience and judgement. Yet, for all the vocal support for digital transformation, we are not optimistic that departments will advance much over the next several years. Ventana Research asserts that by 2025, only one-third of finance departments will have achieved a level of technology competence that could be described as digitally transformed, and the CFOs of those that do will have greater influence on their organization’s management. These are the fast followers who will have a very real advantage in utilizing technology because they will be able to quickly take advantage of advances as they become available. Those that pursue a wait-and-see strategy — and there will be many — will fall behind and underperform their peers.