Ventana Research has published its Workforce Optimization 2016 Value Index. The Value Index provides a comprehensive evaluation of contact center workforce optimization vendors based on responses to our RFP-like questionnaire, which was constructed using insights gained from our recent benchmark research into workforce optimization and our knowledge of the market. In our definition workforce optimization systems include interaction recording, agent quality management, workforce management, agent compensation management, training and coaching, and interaction-handling analytics. The research shows that organizations have deployed many of these applications and by doing so have achieved efficiencies in handling interactions, improved outcomes of those interactions and improved both customer and employee satisfaction.

contact center workforce optimization vendors based on responses to our RFP-like questionnaire, which was constructed using insights gained from our recent benchmark research into workforce optimization and our knowledge of the market. In our definition workforce optimization systems include interaction recording, agent quality management, workforce management, agent compensation management, training and coaching, and interaction-handling analytics. The research shows that organizations have deployed many of these applications and by doing so have achieved efficiencies in handling interactions, improved outcomes of those interactions and improved both customer and employee satisfaction.

Managing the tasks associated with handling customer interactions has become more challenging. Organizations now handle large volumes of interactions through more channels of engagement; our benchmark research into contact centers in the cloud finds that the average number of channels supported by organizations has risen to eight. At the same time the interactions themselves have become more complex, and customer expectations of how well interactions are handled have risen. In addition, more employees throughout the organization – in all business units except IT – now handle interactions.

Workforce optimization technology is increasingly widely deployed. The types of systems in widest use are call recording (by 70% of organizations), quality monitoring (64%) and e-learning (44%); the systems most often planned to be deployed in the next two years are e-learning (36%), workforce management (32%) and coaching (30%). This contact center in the cloud research shows that companies now see analytics as a key tool for improving interaction handling and employee and customer satisfaction. To support decisions about interactions they seek comprehensive views of customers and use more customer-related metrics. They also attempt to link employee performance and customer satisfaction, track employee performance using operational metrics and develop customer journey maps showing the transition from one channel to another and from one employee to another. Vendors of workforce optimization systems and tools are under pressure to support all these capabilities.

The research shows that companies of all sizes increasingly are open to using cloud-based systems and that this trend is likely to accelerate as more small and midsize businesses choose to deploy workforce optimization technology. This trend is especially true for advanced analytics systems; more companies intend to deploy speech, text and event analytics in the cloud than on-premises. Mobility also is having an impact in supporting managers and team leaders working away from their desks, such as when walking a contact center floor to provide real-time coaching, and in supporting home-based agents. Advanced workforce optimization systems therefore need to provide access to key capabilities through smartphones, tablets and other mobile devices. We connect these preferences to another research finding, that usability is a key factor for organizations evaluating software for workforce optimization. In this regard, organizations want a user interface that matches the expectations of modern users – for example, by providing visualization and point-and-click capabilities.

The research also shows the growing importance of systems integration; almost half of organizations said that integration between workforce optimization applications is important. Such integration has a dual impact, making it easier to manage all applications “as one” as well as to share data between systems to automate what have been disconnected manual processes – for example, to connect analytics that identify needed training and workforce management to automatically schedule that training.

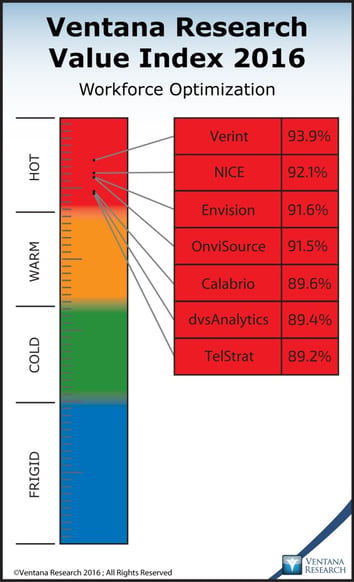

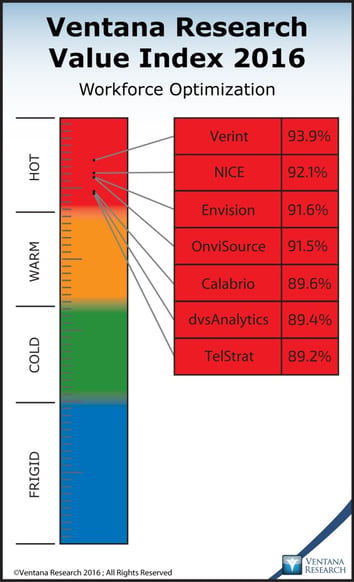

Using these and other insights and responses to the detailed questions enabled us to construct the 2016 Workforce Optimization Value Index questionnaire, in which we divided the questions into seven categories: adaptability, capability, usability, manageability, reliability, vendor validation and support for developing TCO-ROI. We invited 13 vendors to complete this based on the products they had in general release as of March 2016. Six decided not to respond due to resource issues or because the company had been acquired, putting the future of its products into question. Thus the 2016 Workforce Optimization Value Index report includes seven vendors: Calabrio, dvsAnalytics, Envision, NICE, OnviSource, TelStrat and Verint. The findings of our analyses demonstrate the maturity of this market. All seven companies received our Hot rating, and first and last places are separated by fewer than five percentage points. The analysis shows that currently Verint is the top supplier, followed by NICE in second place. This mirrors our 2015 Value Index in which Verint ranked first and NICE third; since then NICE has acquired the 2015 second-place finisher, VPI.

resource issues or because the company had been acquired, putting the future of its products into question. Thus the 2016 Workforce Optimization Value Index report includes seven vendors: Calabrio, dvsAnalytics, Envision, NICE, OnviSource, TelStrat and Verint. The findings of our analyses demonstrate the maturity of this market. All seven companies received our Hot rating, and first and last places are separated by fewer than five percentage points. The analysis shows that currently Verint is the top supplier, followed by NICE in second place. This mirrors our 2015 Value Index in which Verint ranked first and NICE third; since then NICE has acquired the 2015 second-place finisher, VPI.

Both Verint and NICE are well-established global vendors of workforce optimization systems and provide tools for capturing multiple forms of interaction, agent quality management, workforce management, agent compensation management, coaching, training, performance management and analytics. Each of the two built its suite through a combination of in-house development and acquisition, and each has invested to improve integration between the products, build a modern user interface for all modules, and centralize setup, administration and management of them. Each also has invested in providing cloud-based versions of the existing products.

The other five vendors – Envision, OnviSource, Calabrio, dvsAnalytics and TelStrat, in order of rank – are smaller companies that focus predominantly on the U.S. market, although all are expanding to international markets. Their systems were developed largely in-house and thus have the advantages of being tightly integrated, having a common user interface and being managed centrally. Each of these vendors also has developed cloud-based services based on its products.

We urge organizations to do a thorough job of evaluating workforce optimization systems and dig deeper than just the overall rankings as individual company requirements will differ and each will have its own priorities. We offer this Value Index as both the results of our in-depth analysis of these vendors and as an evaluation methodology. The Value Index can be used to evaluate existing suppliers and also provides evaluation criteria for new projects. Applying it this way can shorten the RFP cycle time and enable your organization to optimize its contact center workforce optimization efforts. To learn more and receive a complimentary copy of the report, please visit http://www.ventanaresearch.com/WFOValueIndex/.

Regards,

Richard J. Snow

VP & Research Director, Customer

Follow Me on Twitter and Connect with me on LinkedIn

contact center workforce optimization vendors based on responses to our RFP-like questionnaire, which was constructed using insights gained from our recent benchmark research into workforce optimization and our knowledge of the market. In our definition workforce optimization systems include interaction recording, agent quality management, workforce management, agent compensation management, training and coaching, and interaction-handling analytics. The research shows that organizations have deployed many of these applications and by doing so have achieved efficiencies in handling interactions, improved outcomes of those interactions and improved both customer and employee satisfaction.

contact center workforce optimization vendors based on responses to our RFP-like questionnaire, which was constructed using insights gained from our recent benchmark research into workforce optimization and our knowledge of the market. In our definition workforce optimization systems include interaction recording, agent quality management, workforce management, agent compensation management, training and coaching, and interaction-handling analytics. The research shows that organizations have deployed many of these applications and by doing so have achieved efficiencies in handling interactions, improved outcomes of those interactions and improved both customer and employee satisfaction. resource issues or because the company had been acquired, putting the future of its products into question. Thus the 2016 Workforce Optimization Value Index report includes seven vendors: Calabrio, dvsAnalytics, Envision, NICE, OnviSource, TelStrat and Verint. The findings of our analyses demonstrate the maturity of this market. All seven companies received our Hot rating, and first and last places are separated by fewer than five percentage points. The analysis shows that currently Verint is the top supplier, followed by NICE in second place. This mirrors our 2015 Value Index in which Verint ranked first and NICE third; since then NICE has acquired the 2015 second-place finisher, VPI.

resource issues or because the company had been acquired, putting the future of its products into question. Thus the 2016 Workforce Optimization Value Index report includes seven vendors: Calabrio, dvsAnalytics, Envision, NICE, OnviSource, TelStrat and Verint. The findings of our analyses demonstrate the maturity of this market. All seven companies received our Hot rating, and first and last places are separated by fewer than five percentage points. The analysis shows that currently Verint is the top supplier, followed by NICE in second place. This mirrors our 2015 Value Index in which Verint ranked first and NICE third; since then NICE has acquired the 2015 second-place finisher, VPI.