Reconciling accounts at the end of a period is one of those mundane finance department tasks that are ripe for automation. Reconciliation is the process of comparing account data (at the balance or item level) that exists either in two accounting systems or in an accounting system and somewhere else (such as in a spreadsheet or on paper). The purpose of the reconciling process is to identify things that do not match (as they must in double-entry bookkeeping systems) and then assess the nature...

Read More

Topics:

Office of Finance,

automation,

Reconciliation

I recently attended BlackLine’s annual user conference. The company aims to automate time-consuming repetitive tasks and substantially reduce the amount of detail that individuals must handle in the department. The phrase “the devil is in the details” certainly applies to accounting, especially managing the details in the close-to-report phase of the accounting cycle, which is where BlackLine plays its role. This phase spans from all the pre-close activities to the publication of the financial...

Read More

Topics:

automation,

close,

closing,

Consolidation,

control,

effectiveness,

Reconciliation,

CFO,

compliance,

Data,

controller,

Financial Performance Management,

FPM,

Sarbanes Oxley,

Accounting,

process management,

report

For several years, I’ve commented on a range of emerging technologies that will have a profound impact on white-collar work in the coming decade. I’ve now coined the term “Robotic finance” to describe this emerging focus, which includes four key areas of technology: Artificial intelligence (AI) and machine learning (ML), robotic process automation (RPA), bots utilizing natural language processing, and blockchain distributed ledger technology (DLT), each of which I describe below. Robotic...

Read More

Topics:

ERP,

Machine Learning,

close,

Consolidation,

Continuous Accounting,

Reconciliation,

CFO,

Robotic Process Automation,

blockchain,

AI,

natural language processing,

Accounting,

RPA,

bots,

voice automation

The topic of corporate governance received renewed attention recently after the publication of an open letter signed by 13 prominent business leaders, including Warren Buffett of Berkshire Hathaway and Jamie Dimon of JPMorgan Chase. The first principle the group advocated in the letter is the need for a truly independent board of directors. To achieve that aim, the letter suggests having the board meet regularly without the CEO and that the members of the board should have “active and direct...

Read More

Topics:

Mobile,

Governance,

Human Capital Management,

Office of Finance,

Consolidation,

Reconciliation,

CFO,

CEO,

board of directors,

accounting close

The ERP market is set to undergo a significant transformation over the next five years. At the heart of this transformation is the decade-long evolution of a set of technologies that are enabling a major shift in the design of ERP systems – the most significant change since the introduction of client/server systems in the 1990s. Some ERP software vendors increasingly are utilizing in-memory computing, mobility, in-context collaboration and user interface design to differentiate their...

Read More

Topics:

Performance Management,

ERP,

FP&A,

Human Capital,

Office of Finance,

Reporting,

Consolidation,

Reconciliation,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Uncategorized,

Financial Performance Management,

FPM

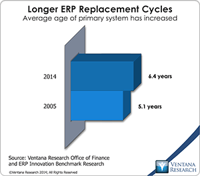

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their...

Read More

Topics:

Big Data,

Microsoft,

SAP,

Social Media,

Supply Chain Performance,

ERP,

FP&A,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Reconciliation,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

IBM,

Oracle,

Uncategorized,

CFO,

Data,

finance,

Financial Performance Management,

FPM,

Intacct

Because my research practice is centered on important business issues where technology is a key part of a solution, my written perspectives tend to focus on technology. However, it’s almost never the case that a company can just implement some application and fully resolve a business issue. Some progress may be achieved by using more effective tools, but in most cases results will fall short of what’s possible unless people, process and information issues are addressed as well. This is...

Read More

Topics:

Office of Finance,

Reconciliation,

Business Performance,

Financial Performance,

Data,

Document Management

Reconciling accounts at the end of a period is one of those mundane finance department tasks that are ripe for automation. Reconciliation is the process of comparing account data (at the balance or item level) that exists either in two accounting systems or in an accounting system and somewhere else (such as in a spreadsheet or on paper). The purpose of the reconciling process is to identify things that don’t match (as they must in double-entry bookkeeping systems) and then assess the nature...

Read More

Topics:

Office of Finance,

automation,

close,

closing,

Consolidation,

Controller,

effectiveness,

Reconciliation,

XBRL,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

Data,

Document Management,

Financial Performance Management,

FPM

Back-office operations in commercial and investment banks are among those critical functions that are underappreciated until they stop working well. This includes transaction reconciliations and the related exceptions management. Reconciliations are necessary to achieve a reasonable assurance of complete and accurate record of trading activity. The process is especially challenging now, partly because of today’s high and growing volumes in the wide range of asset classes in which all larger...

Read More

Topics:

GRC,

Office of Finance,

Financial Governance,

Reconciliation,

Sungard,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

Information Management,

CFO,

Corporate Governance,

Governance Risk and Compliance