Ventana Research defines financial performance management (FPM) as the process of addressing often overlapping issues involving people, process, information and technology that affect how well finance organizations operate and support the activities of the rest of their organization. FPM software supports and automates the full cycle of finance department activities, which include planning and budgeting, analysis, assessment and review, closing and consolidation, internal financial reporting and external financial reporting, as well as the underlying information technology systems that support them.

Over the past couple of years, I’ve written about the convergence of transactions and analytical systems, in this case ERP and FPM, respectively. Each software vendor is taking its own approach, but the result is that the lines between product categories are becoming blurred. In the case of ERP software, the evolution is beginning to produce what customers 25 years ago thought they were buying: a comprehensive financial management system that records transactions and provides timely, useful information to executives. What they really bought back then was a data roach motel that required integration with an analytical system such as financial performance management (what some other vendors and analysts call corporate or enterprise performance management).

For years, some ERP vendors offered built-in dashboards and other ways of displaying and communicating some of the information stored in the ERP system. However, the scope of the data was limited and not always current because of limitations imposed by the system’s data structure and processing power. In recent years, that has changed as ERP vendors have been developing a variety of architectures to make information more easily accessible.

At the headquarters level, companies have been using FPM software alone or with some form of central data store to achieve a consolidated view of their financial performance and position. Our benchmark research on the financial close finds that 62 percent of companies with more than 1,000 employees have two or more ERP systems while 29 percent have three or more. It also reveals that 70 percent of companies have a dedicated financial data warehouse. However, ERP system architectures are evolving to enable corporations to deal with financial system fragmentation by amalgamating entries from all accounting software into a single, unified headquarters system. Vendors use different approaches, but the end result will be a single unified ledger.

A unified headquarters ERP architecture also enables a corporation to maintain a continuous, company-wide soft close, which permits senior executives to more easily monitor company-wide financial conditions at a more detailed level. Such an ERP system is able to generate instant trial balances from which almost all companies can create up-to-the-moment detailed reports and analyses (although daily or even weekly updates will be perfectly adequate for most). Consequently, the ERP system will be able to provide the basic reporting and analytics that are now performed by financial performance management software. A unified headquarters ERP system is likely to be able to manage statutory consolidations, which are now handled by dedicated applications that are part of the FPM suite.

As the scope of ERP systems expands to include more performance management capabilities, it brings into question the future of the FPM category. To be sure, there is little threat to the FPM market over the next several years because of the slow pace at which organizations typically replace their ERP systems. Even though basic analysis and reporting and even statutory consolidation may wind up as part of the ERP software category, there are ways in which the FPM category can maintain relevance.

One of them is by making sophisticated analytics more accessible. Some vendors already stress their ability to provide predictive analytics (algorithms that predict future behavior or outcomes) as well as prescriptive analytics (the application of predictive analytics to prompt management decisions that will produce desired outcomes). Our next-generation business planning research reveals that only 20 percent of companies use predictive analytics extensively. Over the years I’ve observed a widespread lack of analytics talent in companies, even in finance departments. FPM systems can address this deficit by applying machine learning (the use of algorithms that have the ability to change or “learn” as they observe more data from more outcomes to events). The application of machine learning is what is meant today by the old term “artificial intelligence.”

Business planning is another area where FPM vendors can provide extended capabilities to remain relevant as a distinct category. Ventana Research defines business planning as encompassing all of the forward-looking activities in which companies routinely engage. The most common types include capital, demand, marketing, project, strategic, supply chain and workforce planning, as well as sales forecasting and corporate budgeting. The application of more sophisticated analytics to planning is one way that FPM vendors can remain relevant. Predictive analytics can produce nuanced forecasts that are more accurate, especially if the system utilizes machine learning to continually refine the predictive models. Predictive analytics also is useful as an alerting mechanism. When results begin to diverge enough from a forecast to be significant, predictive analytics can create an alert that notifies affected parties that action may be necessary.

Integrating the various business planning activities across a company benefits senior leaders, as I have written, by enabling them to understand both the operational and the financial consequences of actions before they take them.

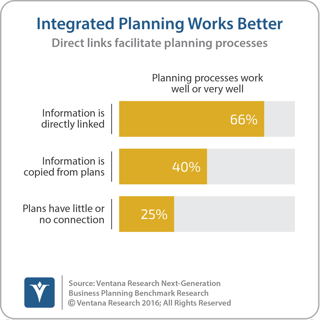

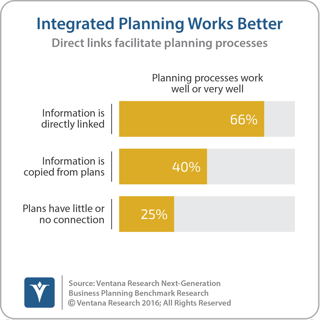

There are multiple planning efforts under way at any time in a company. These plans typically are stand-alone efforts only indirectly linked to others. To be most effective, however, an individual business unit plan requires direct inputs from other planning efforts. More than a decade ago I coined the term “integrated business planning” to emphasize the need to use technology to better coordinate the multiple planning efforts of the individual parts of the company. There are good reasons to do this, one of which is accuracy. Our business planning research finds that to be accurate, most (77%) planning processes depend to some degree on access to accurate and timely data from other parts of the organization. For this reason, integrating the various planning processes produces business benefits: In our research two-thirds of companies in which plans are directly linked said that their planning process works well or very well. This compares favorably to 40 percent in those that copy planning data from individual plans to an integrated plan (such as the company budget) and just 25 percent of those that have little or no connection between plans.

There are multiple planning efforts under way at any time in a company. These plans typically are stand-alone efforts only indirectly linked to others. To be most effective, however, an individual business unit plan requires direct inputs from other planning efforts. More than a decade ago I coined the term “integrated business planning” to emphasize the need to use technology to better coordinate the multiple planning efforts of the individual parts of the company. There are good reasons to do this, one of which is accuracy. Our business planning research finds that to be accurate, most (77%) planning processes depend to some degree on access to accurate and timely data from other parts of the organization. For this reason, integrating the various planning processes produces business benefits: In our research two-thirds of companies in which plans are directly linked said that their planning process works well or very well. This compares favorably to 40 percent in those that copy planning data from individual plans to an integrated plan (such as the company budget) and just 25 percent of those that have little or no connection between plans.

The research also shows that on average 70 percent of organizations use spreadsheets across the range of their business planning activities. Over time it’s likely that this percentage finally will begin to decline as vendors develop offerings that provide users with software that is a real alternative to desktop spreadsheets as I have described. By this I mean software that provides business users with the same ability to model, create reports and work with data that they get in using a desktop spreadsheet without any IT resources. Another factor displacing spreadsheets is the increasing use of cloud-based planning applications designed for specific functional groups (such as marketing). To the extent that these point solutions become widely adopted, FPM vendors will need to have the ability to link them to an FPM suite to support integrated business planning.

As the functional footprint of ERP systems expands further into financial analysis, consolidation and reporting, FPM software vendors will need to adapt. Although some of the core capabilities of today’s FPM systems are likely to be assumed by ERP software over the coming decade, there is scope for FPM vendors to use technology to innovate and expand the capabilities of their software. Those that are able to do so will survive and thrive. Users and prospective buyers of FPM software should carefully monitor vendors’ strategic directions and capabilities to avoid obsolescence.

Regards,

Robert Kugel

Senior Vice President Research

Follow Me on Twitter @rdkugelVR and

Connect with me on LinkedIn.