Through a continuing program of acquisitions and internal development, NICE Systems has transitioned from being a vendor of workforce optimization systems to one focused on aspects of the customer experience, notably voice of the customer (VOC), customer engagement analytics and customer journey mapping. It is also moving to cloud-based services from products installed on customers’ premises and is taking a business-solution approach (providing previously integrated and configured products that address specific business issues) rather than general-purpose products. All of these changes are evident in its latest services, which link VOC, real-time journey mapping and predictive analytics to address common customer service and engagement issues. The foundation for these packages are products I have previously covered – Fizzback for multichannel customer surveying and feedback analysis and Causata for a big data analytics platform that includes predictive analytics capabilities – along with its own customer engagement analytics platform, which can link customer data from disparate sources. The result, for example, is that journey maps can show all interactions on all channels a customer uses to try to resolve issues, including the customer sentiment at each touch point and the outcome of the journey.

The key to NICE’s portfolio is its ability to collect and share data in real time, and to integrate its products to create specific packaged business solutions. Using these enables companies to determine which customers are engaging with them, on what channels, what the interactions are about, what the outcomes are, what was “said” by both parties during interactions, the customers’ sentiments during and after the interaction, and how well employees performed. With this information companies can be more proactive in serving customers during and after interactions.

NICE currently offers seven packages: two that span operational improvements, two for prioritizing business initiatives and three aimed at improving return on investment (ROI) for customer engagement. The first of the two that support operational improvements allows companies to determine customer effort scores at different points in customer journeys and initiate proactive engagement to reduce the need for customers to contact them in the future or to make future engagement easier. The second determines the reason why customers are engaging and the customer sentiment to guide employees in handling current and future interactions.

The first package for prioritizing business initiatives allow companies to calculate customer value and use this to influence future actions (for example, making special offers to high-value customers), and the second tracks the journeys of dissatisfied customers to identify potential process improvements that might result in improved customer satisfaction and net promoter scores. The first of the three for improving ROI allows companies to track journeys across touch points and identify actions that increase customer effort and churn (for example, not fully explaining how a product works) and change processes to avoid such actions. The second produces more granular customer segments to help drive more focused customer service and engagement in the future. And the third maps customer sentiment at different points in the customer journey so processes and training can be changed to impact the flow and outcome of future interactions.

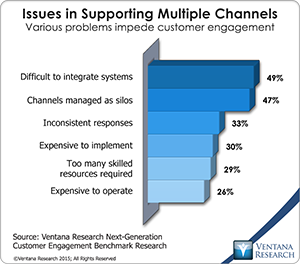

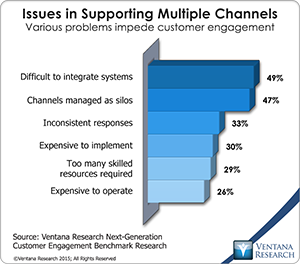

Our benchmark research into next-generation customer engagement  shows that many companies struggle to support multiple channels to extend their customer engagement: Nearly half have difficulty in integrating systems (49%), manage channels of engagement as silos (47%) and give customers inconsistent responses (33%). The NICE packages help companies identify where these issues are occurring and more importantly their consequences; for example, if one business group gives customers information that differs from what they receive through a self-service channel, this could generate a series of other interactions that reduce customer satisfaction and increase operational costs. The real-time journey maps show what customers are doing and the outcomes, analysis ties together process and people issues and can recommend action, and predictive capabilities identifies changes to be made before counterproductive actions occur again. Using data from many disparate sources companies can link actions to performance metrics and at the same time show the benefits of change; for example, it can show variations in net promoter scores by customer segment and suggest actions to be taken for different groups, and it can tie customer value changes to actions, thus indicating the future actions that are likely to achieve the best return. In applying technology to business what counts most is understanding the impacts of actions. These NICE packaged solutions enable users to develop insights they need to make changes, and I recommend that companies looking to improve the customer experience give them careful consideration.

shows that many companies struggle to support multiple channels to extend their customer engagement: Nearly half have difficulty in integrating systems (49%), manage channels of engagement as silos (47%) and give customers inconsistent responses (33%). The NICE packages help companies identify where these issues are occurring and more importantly their consequences; for example, if one business group gives customers information that differs from what they receive through a self-service channel, this could generate a series of other interactions that reduce customer satisfaction and increase operational costs. The real-time journey maps show what customers are doing and the outcomes, analysis ties together process and people issues and can recommend action, and predictive capabilities identifies changes to be made before counterproductive actions occur again. Using data from many disparate sources companies can link actions to performance metrics and at the same time show the benefits of change; for example, it can show variations in net promoter scores by customer segment and suggest actions to be taken for different groups, and it can tie customer value changes to actions, thus indicating the future actions that are likely to achieve the best return. In applying technology to business what counts most is understanding the impacts of actions. These NICE packaged solutions enable users to develop insights they need to make changes, and I recommend that companies looking to improve the customer experience give them careful consideration.

Regards,

Richard J. Snow

VP & Research Director