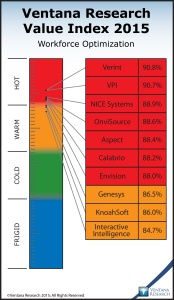

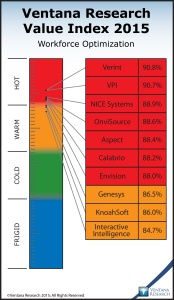

As with many other research topics, Ventana Research investigates workforce optimization in two ways. Our benchmark research into next-generation workforce optimization assesses how companies use workforce optimization systems now and intend to in the future, while our Workforce Optimization Value Index evaluates how well workforce optimization products and vendors match buyers’ needs. In our newly released 2015 Workforce Optimization Value Index the top vendors are Verint and VPI, both rated Hot, followed by five other Hot vendors: NICE Systems, OnviSource, Aspect, Calabrio and Envision. The overall scores place all seven Hot vendors within four percentage points of each other, and only a further three percentage points separate the three Warm vendors – Genesys, KnoahSoft and Interactive Intelligence. The closeness of the scoring suggests that this is a mature market and in most respects vendors support much the same features.

evaluates how well workforce optimization products and vendors match buyers’ needs. In our newly released 2015 Workforce Optimization Value Index the top vendors are Verint and VPI, both rated Hot, followed by five other Hot vendors: NICE Systems, OnviSource, Aspect, Calabrio and Envision. The overall scores place all seven Hot vendors within four percentage points of each other, and only a further three percentage points separate the three Warm vendors – Genesys, KnoahSoft and Interactive Intelligence. The closeness of the scoring suggests that this is a mature market and in most respects vendors support much the same features.

Among the seven categories by which we assess vendors, the three that have the greatest impact on an organization’s propensity to buy a new workforce optimization systems are capabilities, usability and reliability, which about two-thirds of organizations view as very important. A closer look at each vendor’s capabilities shows that in general all of the products support core capabilities and rate very similarly for all the subcategories. The primary exception is in agent variable compensation management where NICE Systems and Envision both have strong capabilities, whereas the other vendors are mostly limited to providing the data for other systems to calculate compensation. The lowest-ranked vendor, Interactive Intelligence, as noted in the summary of the results, is newer to this market and in the process of developing a full range of capabilities.

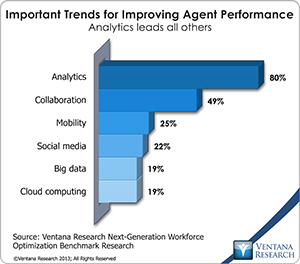

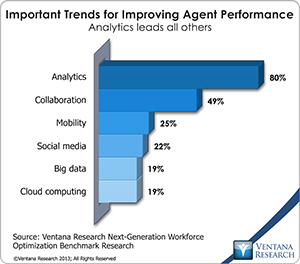

Our workforce optimization benchmark research finds that regarding emerging capabilities, organizations rate analytics as their top priority in 80 percent of organizations. In this respect the three longest-established vendors – Aspect, NICE and Verint – have the best capabilities, with Interactive Intelligence, KnoahSoft and OnviSource behind them. NICE Systems and Verint have both been investing heavily in analytics so their products can utilize all forms of data and produce customer journey maps, which are increasingly becoming a “must have” for companies seeking to improve agent and customer satisfaction. We advise potential buyers to pay attention to the range of data sources a product can process, links between agent performance and customer feedback, the ability to generate performance metrics and flexibility in how outputs are presented (which I will come back to below).

Our workforce optimization benchmark research finds that regarding emerging capabilities, organizations rate analytics as their top priority in 80 percent of organizations. In this respect the three longest-established vendors – Aspect, NICE and Verint – have the best capabilities, with Interactive Intelligence, KnoahSoft and OnviSource behind them. NICE Systems and Verint have both been investing heavily in analytics so their products can utilize all forms of data and produce customer journey maps, which are increasingly becoming a “must have” for companies seeking to improve agent and customer satisfaction. We advise potential buyers to pay attention to the range of data sources a product can process, links between agent performance and customer feedback, the ability to generate performance metrics and flexibility in how outputs are presented (which I will come back to below).

Another emerging key capability is collaboration. My benchmark research into customer analytics finds that many companies are now focused on improving first-contact resolution rates, which have a direct impact on customer satisfaction. Collaboration can help in achieving this goal because it enables everyone to reach out to a colleague or an expert if they are having difficulty resolving customers’ issues. It also helps supervisors share performance information with an agent and to enables immediate coaching. However, the new Workforce Optimization Value Index finds this to be area in which most vendors are weak. Aspect rated highest in this capability, followed by Interactive Intelligence; both use their communication platforms to provide such capabilities.

The combination of our benchmark research and the Value Index reveals a contrast between the importance to companies of cloud computing, which ranked last among next-generation technologies, and capabilities offered by vendors, which rated highest in their support for cloud computing. All the vendors except VPI rated Hot in this subcategory, putting them seemingly ahead of market demand. The research provides insight into why this is in that it finds a direct correlation between size of contact center and propensity to invest in workforce optimization – most small centers rely on spreadsheets. However, we expect this to change as centers of all sizes realize that handling multiple forms of interaction across multiple channels requires more sophisticated systems to make the right number of skilled agents available to handle expected volumes of interactions. Overall the Value Index shows that apart from cloud computing none of the vendors is especially advanced in innovative technologies; this shortfall held down overall scores.

Of equal importance to capability is usability, which Ventana Research finds is of growing importance for all products. There are several aspects to usability. First is the user interface. Here the smaller vendors have a slight advantage because their suites have been developed from the ground up so the interface is common across all applications. Calabrio is the top vendor in this category; it has invested heavily in making its products easy to use, especially for younger “millennial” workers. NICE Systems and Verint face the biggest challenges in this area because their suites have been built largely through acquisitions; each is now investing to provide a common user interface across all applications. Another important aspect of usability is support for accessing systems through mobile devices. The Value Index shows that workforce optimization vendors are not advanced in this area, although Aspect, OnviSource and VPI are the top ranked. Sharing information is also key to workforce optimization and although the vendors all have standard capabilities to, for example, attach reports to email, none has very advanced support for Facebook-like capabilities to enable this aspect of collaboration.

The third category of most importance is reliability, which is linked with the overall product architecture. All the vendors scored closely in this category, with OnviSource standing out because of recently investment in this area.

Most vendors put a great deal of effort into creating case studies and customer examples, but validation of vendors ranks last in the list of categories most important to potential buyers.  Companies can access plenty of information on the Internet and check out vendors using social media. Just above validation is TCO/ROI, which only half (52%) of companies rated as important. This is surprising because very few companies will invest in any software unless they can build a compelling business case for it. In the Value Index VPI, Calabrio and Verint rank highest for the tools and services they have to support prospective buyers in this area.

Companies can access plenty of information on the Internet and check out vendors using social media. Just above validation is TCO/ROI, which only half (52%) of companies rated as important. This is surprising because very few companies will invest in any software unless they can build a compelling business case for it. In the Value Index VPI, Calabrio and Verint rank highest for the tools and services they have to support prospective buyers in this area.

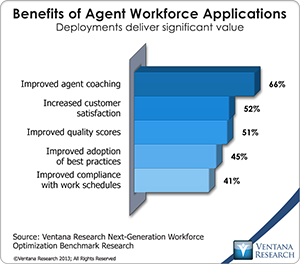

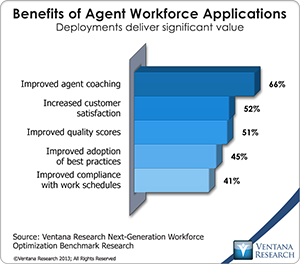

Of course companies have different priorities, processes and requirements when it comes to choosing new software. Although the workforce optimization market is quite mature, the requirements have become more complex because customers now expect to have their issues resolved at the first attempt, no matter what channel they use to interact. This is borne out by the benefits received by companies that have invested in advanced systems. Of the top five, four relate to improving agent performance, which typically results in reduced operational costs and more highly skilled agents, which in turn significantly impact the fifth benefit, improved customer satisfaction; most of my research finds that is the top priority for companies. The next-generation workforce optimization research finds that many companies are thinking of investing in workforce optimization systems over the next two years. For them our benchmark research will reveal what other companies have planned, and our Value Index will show how well the vendors match these expectations.

Regards,

Richard J. Snow

VP & Research Director